FAQ

Frequent questions

IBAN is the acronym for International Bank Account Number and is a bank code used to uniquely identify each current account.

- Companies located inside and outside the European territory

- Natural persons located inside and outside the European territory.

- SWIFT: It is the acronym for “Society for Worldwide Interbank Financial Telecommunication” to give name to the identification code of an international transaction. It is also known as “BIC” for “Bank Identifier Code”.

- SEPA: The Single Euro Payments Area (SEPA) is the area in which citizens, companies and other economic agents can make and receive payments in euros in Europe, within and across national borders, under the same conditions and with the same rights and obligations, regardless of their location.

- Faster Payments: It is a UK banking initiative to reduce payment times between customer accounts at different banks to a few seconds from the three business days that transfers typically take using the long-established BACS system.

- CHAPs: The Clearing House Automated Payments System (CHAPS) is a company that facilitates large sterling (GBP) denominated money transfers. Over 5000 institutions participate in the system through partnership agreements with the top 30 members.

CHAPS allows funds to be transferred almost instantaneously, minimizing the risk of loss or theft.

- BACs: BACS (Bacs Payment Schemes Limited) payments are money transfers sent between banks or financial institutions in the UK. The system used to make these payments has been in existence for over 50 years and is considered secure and reliable.

- ACH: An ACH transfer is an electronic transfer of funds between banks and credit unions, through what is known as the Automated Clearing House network.

- Local Payments: In addition, you have local payment channels and transfer methods in more than 160 countries.

Yes, Futswap Neobanking accounts are checking accounts.

Individual Accounts

In your individual Futswap Neobanking account you can exchange, send and receive the following currencies

Corporate Accounts

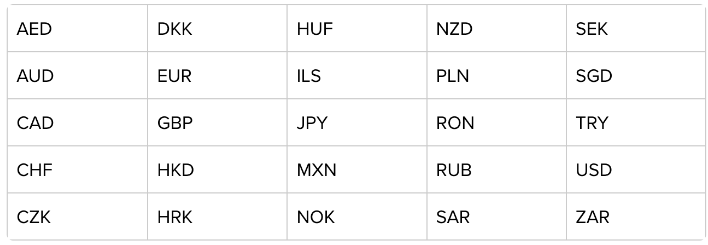

In your corporate Futswap Neobanking account you can exchange, send and receive the following

A multicurrency bank account is a bank account that allows account holders to hold and manage funds in different foreign currencies in addition to their local currency.

This means that holders of a multicurrency account can conduct transactions in multiple currencies, such as receiving and sending money in different currencies, making international transfers, and conducting transactions in foreign currencies without having to convert the funds to their local currency.

With a multi-currency IBAN, account holders can receive and make transfers in different currencies, such as US dollars, euros, pounds sterling, yen, among others, without the need to open separate accounts for each currency.

- Individual accounts are generally verified within 24 hours of application and form signature.

- Corporate accounts may take 48-72 hours from application.

- Once you are logged in, click on View all accounts.

- There you will find the account details (account number, sort code, IBAN and SWIFT/BIC according to the currencies available in your account) for each currency.

- Use these details for deposits to your account.

You can send money in GBP and in various currencies. To do so, follow the steps below.

- Login to https://futswap.uk/login

- Click on Payments and Transfers.

- In this section you will be able to choose between: To my account; To another customer; UK local; European; International.

- Enter the amount, currency, and recipient’s account details.

- For UK local transfers, choose Faster Payments (FPS) as your payment method.

The time it takes for a transfer to become effective depends on the destination. However, here are the following

- To another Futswap NeoBanking account: instantaneous

- To a local UK account: usually instant, but can take up to 2 hours.

- To a European account: usually 1 to 4 business days

- To an international account: usually 2 to 5 business days

You can download the transfer voucher from your Payments and Transfers activities in your control panel.

Click on the transaction you want to download the receipt for and you will see a pop-up window with its details and a download button.

Your funds are credited to your account as soon as they are received from the correspondent bank. Generally, UK local transfers are instantaneous or may take up to 24 hours on business days.

SEPA and international (SWIFT) transfers are not instantaneous and may take 1 to 5 business days to be credited.

Some banks may also route money through an intermediary bank if there is no direct relationship between your bank and the destination bank. This can also make the process slower.

Contact our support team through our live chat or email [email protected].

The current default login authentication is via an SMS code received on your registered cell phone number, but you can also set up login via the Authenticator application as a backup method. This will allow you to get the code also when your phone is offline.

To do so, follow the steps below:

- Log in and go to settings.

- Click on the Security tab.

- Go to Two-Step Verification and click on the Authenticator option.

- Download an authenticator app on your mobile device if you don’t already have one. We suggest Google Authenticator, but any other authentication app will work.

To make a currency exchange in your account, follow the steps below:

- Log in and go to the Currency Exchange tab.

- Choose the account you wish to exchange from.

- Enter the amount and currency you wish to exchange. On the screen, you will see the exchange rate and the resulting amount of the transaction.

You can make currency exchanges Monday through Friday between 9 AM and 6 PM (GMT). If you try to do it outside this time period, your exchange will be rejected.

If this is not the case, please contact our support team.

Usually, an outgoing transfer is pending because it is under review. Once the transfer is approved, we will execute the transaction.

If the transfer is pending for more than 24 hours, please contact our support team.

To create a monthly statement, follow the steps below:

- Log in and go to Payments and Transfers.

- Select all accounts or the account for which you want to create the statement.

- Click on Sort by date and select the date range for which you want the document.

- Select the Save or Print icon and choose the format you want.

When you fill in the details to send a transfer, you have the possibility (at the end of the form) to save the recipient as a template by checking the box Set template name. However, if you want to add a new recipient manually, you can do it through the following steps:

- Log in and click on Payments and Transfers.

- Select the Templates tab and click Create Template.

- Choose the recipient’s payment method and fill in the details.

Remember: Although the template includes an amount, you can modify it each time you make a new transfer.

Yes, to do so, follow the steps below:

- Log in and click on Payments and Transfers.

- Fill in the details to send a transfer, and before completing the transfer, choose the Schedule Payment option.

To add users to your corporate account, complete the access roles form and submit it to our support team.

To apply for a card, you must have a verified individual Futswap account. The card can only be applied for by UK residents (fees may apply, see our Fees – Personal section).

They are applied at the time of the currency exchange and you will be able to see the rate before completing the transaction.

Yes, there is an additional cost. Please refer to our fees section for more information.